National Broadband Plan (NBP) – Investment Structure Explanation

1. NBI Structure

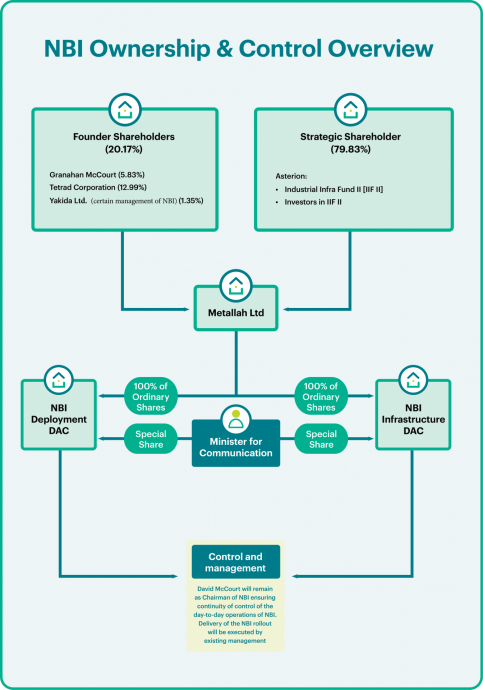

NBI is a privately owned group of Irish incorporated companies made up of:

1.1 Metallah Limited, which is a holding company of the two operating companies;

1.2 NBI Infrastructure DAC, which is the party to the Project Agreement with the Minister for the Environment, Climate and Communications (the “Minister”) and is therefore the entity primarily responsible for the overall National Broadband Project; and

1.3 NBI Deployment DAC, which is the party to a sub contract with NBI Infrastructure DAC under which it is responsible for the design and build of the national broadband network.

It is a common feature of infrastructure projects to separate the design and build role from the operational role.

2. NBP Funding Model

The current funding model for the NBP is comprised of three parts:

2.1 investor funding: the funding model for the Project envisages staggered drawdowns of investor commitments. It is a common feature of private investments in infrastructure projects that shareholder investments are structured as a combination of shareholder equity and shareholder loans. In corporate finance terms, shareholder loans are generally considered equivalent to equity. Shareholder loans are not to be confused with third party debt. The shareholder loans are unsecured. Although interest accrues in relation these loans, none has been paid to date and there are no plans to pay any at this time. Interest on shareholder loans is part of the approved budget for the NBP;

2.2 revenues generated through the customer use of the NBP network;

2.3 publicly funded subsidy payments, which are required because it was not commercially viable to deploy and operate the NBP network over the life of the project. Publicly funded subsidy payments of this type are subject to very stringent requirements under EU State Aid rules and the terms of the Project Agreement and can only be used for expenditure that is expressly permitted under the terms of the Project Agreement.

3. Investor Funding

3.1 NBI’s successful bid for the NBP project included an investor funding commitment of €175,000,000. Notwithstanding this, as a matter of prudence the funding structure put in place involved total investor commitments of €223,000,000.

3.2 These are funds committed by the investors, to be paid when NBI calls for them. It is a common feature of private investments that such investments are structured as commitments to be drawn down when the business needs the funds.

3.3 On the Effective Date (9 January 2020), €100,000,000 of the total investor commitment was drawn down by NBI. It is typical feature of private investments that they are structured as a combination of shareholder equity and shareholder loans. The split of the €100,000,000 was €2,000,000 equity and €98,000,000 of shareholder loans. Unlike third party debt, these shareholder loans act more like equity as they are unsecured and thus at similar risk to equity.

3.4 In December 2021, a further €20,000,000 of the total investor commitment was drawn down by NBI in unsecured shareholder loans. In November 2022 a further €25,000,000 of investor funding was drawn down.

3.5 The undrawn balance of the €175,000,000 sum mentioned above is the subject of guarantees from certain of NBI’s investors.

3.6 Therefore, to date, NBI has drawn down a total of €145,000,000 from the investors and it has the right to draw an additional €78,000,000 when the business needs such funds.

4. Ownership of NBI

NBI Secures Ministerial Consent for Change in Ownership

On Tuesday, 12 July 2022 it was announced that, subject to requisite consents and approvals, Asterion Industrial Partners [‘Asterion’], a pan European long term infrastructure investment manager, had agreed to acquire the interests in NBI of Oak Hill Advisors, Twin Point Capital and certain minorities.

On Wednesday, 19th October 2022 Minister of State Ossian Smyth confirmed that he had advised Government, of his decision to grant Ministerial consent in respect of NBI’s proposed change of ownership and on Friday, 11 November 2022, NBI confirmed that the transaction had completed. (Quarterly Update)

Following this transaction Asterion has become an 80 per cent shareholder in NBI. The remaining 20 per cent of NBI will continue to be held by founding shareholders Granahan McCourt (the investment vehicle of Granahan McCourt Capital and Tetrad Corporation) and by Yakida Ltd. Further information on the ownership structure is shown below.

Granahan McCourt (an investment vehicle of Granahan McCourt Capital and Tetrad Corporation) and Yakida Ltd will retain their current interests in NBI and, together with Asterion, will be responsible for delivering all the shareholders’ commitments and guarantees in relation to the NBP in accordance with the Project Agreement. David McCourt will remain as Chairman of NBI, ensuring continuity of control of the day-to-day operations of NBI and the roll out of the NBP will be executed by existing NBI management.

5. Changes in Ownership and Control

The Project Agreement contains restrictions around changes in the ownership and control of NBI:

5.1 the sale of any shares in NBI during the period up to the completion of deployment to 100% of premises and 12 months thereafter (i.e. until approximately 2027) requires the written consent of the Minister;

5.2 any direct or indirect change of control (being a 30% test) during the period up to the completion of deployment to 100% of premises and 12 months thereafter (i.e. until approximately 2027) requires the written consent of the Minister;

5.3 any transfer by David McCourt of any direct or indirect interest in NBI during the period up to the completion of deployment to 100% of premises and 12 months thereafter (i.e. until approximately 2027) requires the written consent of the Minister; and

5.4 sales to unsuitable third parties (e.g. persons with criminal convictions or who are prohibited from participation in public procurement procedures or who are a threat to national security) are prohibited at all times.

The Minister’s consent was accordingly sought and received in respect of the transaction that saw Asterion becoming an 80 per cent shareholder.

6. Project Costs

6.1 Payment of subsidy to NBI is subject to detailed and specific reporting requirements and the project financial model. Only certain costs incurred by NBI (referred to as permitted expenditure) attract a subsidy payment from the Minister. Subsidy is only payable upon the incurrence by NBI of costs that qualify as permitted expenditure AND the achievement of milestones in accordance with the Project Agreement. In addition to the Government’s own advisors’ oversight of subsidy payments, an independent certifier must confirm that the milestones have been achieved.

6.2 NBI and the Minister agreed to bear their own costs, expenses, legal payments and liabilities incurred in respect of the preparation, execution and implementation of and compliance with the Project Agreement. All costs related to the sale to Asterion have been borne by the shareholders and not by NBI.

6.3 Prior to signing the Project Agreement, Granahan McCourt incurred significant costs during the bid stage, in relation to technical, financial, legal and tax due diligence, project development and related matters. Granahan McCourt was fully on risk for those costs during the bid period. The Project Agreement envisaged that such costs would be reimbursed by NBI. This reimbursement was not funded from subsidy paid by the State. It is ordinary course for successful bidders in procurement processes to recoup bid costs as part of the implementation of the successful bid.

Contract Summary

Under the National Broadband Plan (NBP) Contract, National Broadband Ireland (NBI) will roll out a high speed and future proofed broadband network within the State Intervention Area and will operate and manage this network over the next 25 years.

The contract was published in redacted form by the Government in August 2020 and updated in November 2022 and is a detailed document which sets out the specific terms governing the rollout of the high speed broadband network under the State intervention. The contract is published here gov.ie – National Broadband Plan Contract (www.gov.ie)

NBI has produced a contract summary document. By its very nature the summary document does not seek to cover every aspect of the contract but is intended to assist the reader in navigating, understanding and explaining the contract.

View Contract SummarySubsidy Received

Subsidy provided by the State is in satisfaction of NBI delivering project milestones as defined by the Project Agreement. NBI has not been and will not be paid by the State if it does not deliver these milestones.

To 31st October 2023, NBI had received subsidy totalling €550m which partly reimburses “Permitted Expenditure” incurred. Total “Permitted Expenditure” incurred and validated to that date comprised:

| Design, Build and Connections | €363m |

| Materials | €63m |

| Active Equipment, co-location facilities and systems | €98m |

| Network Infrastructure | €72m |

| Operations | €92m |

| Total “Permitted Expenditure” | €688m |

Note: Bid Costs are not Permitted Expenditure and as such no subsidy has been used to pay costs associated with the NBP bid process.